This is not a post about hating the Fed and how we should get rid of it. This is a post about the rest of us and how convenient it is to have the Fed to complain of.

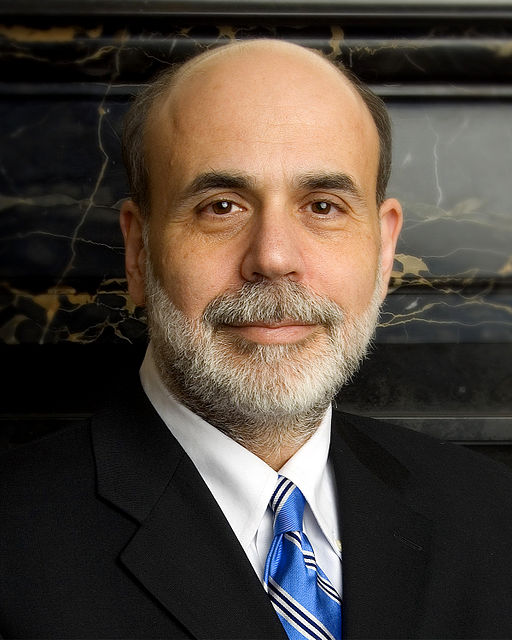

I was tempted to title this post, “The rabble are out to crucify Ben—there’s even a Judas” (now that Paul Krugman, the Fed chief’s former Princeton colleague, has taken to assailing Benanke’s performance in print). But that would have been just one more example of the phenomenon I’m out to criticize: finger-pointing.

It would be tough to judge a finger-pointing contest these days. As the economy flails in the long wake of the financial crisis, everyone in every party seems to be training to become a finger-pointing champion. What interests me about the attacks on the Fed, however, is that even anti-government types now seem caught up in thinking that tinkering with the government is the key to solving problems that—let’s face it—the American private sector created.

The federal government is powerful, but more powerful still are the aggregated interests that pump out more than $15 trillion worth of goods and services a year. That was our GDP in 2011, a CIA Factbook figure. If you hold a job, work in a profession, run a multinational, or own a small business, you are part of that great engine. Simply put: we are the economy. The mess is ours.

Perhaps this is why we feel such scorn for Ben Bernanke, a man so sincere and conscientious it’s irritating. Love him or hate him, it’s hard to claim he isn’t doing his utmost to fulfill the Federal Reserve’s dual mandate, which is to stabilize prices AND move the country toward full employment.

That’s right: one soul at the helm of the Federal Reserve, believes that, by controlling the amount of money in circulation, he can sufficiently influence the sort of corporate decision-making needed to end joblessness. He hopes that, by tweaking our monetary policy, he can prompt our American brothers to give another American brother a job, until every brother and sister in our economy is once again working.

This is why, in Mr Bernanke’s increasingly frequent public appearances and statements, he can be heard fretting about, say, whether long-term unemployment could lead to a permanent loss of human capital in the economy. He truly believes that getting all of America back to work is his responsibility.

He may be the only American who feels that, unfortunately. This is why hating the Fed is so misguided and self-deceiving. Hating the Fed is a cop-out, a lazy habit that absolves the rest of us from looking around us and asking who else might bear some responsibility. Our national preoccupation with monetary policy is a convenient dodge, diverting us from the fact that we ourselves could do something.

We are the economy. Regardless of the shortcomings of the Fed and Mr Bernanke, we owe it to the jobless to recognize their lot as a social, civic, and humanitarian problem, one that’s in our power as a society to remedy.

Should we destroy the one thing that’s working?

Obviously not. The Fed would matter a lot less if we could manage to get some other things working as well as it does. If we didn’t have institutions like the Fed, it would be up to Americans in their respective states and communities to figure out how to alleviate joblessness and destitution and restore prosperity.

This was our lot earlier in our history, when Americans operated with a mere fraction of what now passes for economic understanding. In those times, punishing downturns such as those occurring in 1837, 1873, and 1893, led not only to protracted suffering but also to constructive cultural and social ferment, an outpouring of philanthropic zeal, and more than a little genuine soul-searching.

The Panic of 1837, for instance, prompted the formation of some of our earliest urban relief organizations, while the banking crisis of 1856 gave way to a religious reawakening in 1857 known as “the Businessmen’s Revival.” Chief among the converts were Manhattanites who concluded their own godlessness and greed were to blame for the economic adversity they were suffering. Such heartfelt contrition and public avowal of responsibility, even in secular form, have been all but missing from our present-day financial crisis.

We can’t hope to lessen joblessness if we don’t recognize our obligations to one another. We can’t hope for national prosperity when so many of our fellow Americans are jobless and poor. The common-sense idea that we must care for one another, even if only for selfish reasons, is crucial if we are to re-energize our economy. It might not be an idea Ben Bernanke can teach us, but it sure is one that we can use.

Want help • Foreswear laissez-faire • Use all the tools

Hire a fellow American • Talk to the rich guy

RELATED:

Susan Barsy, Fiscal Policy is not Economic Policy, Our Polity.

Dean Baker and Kevin Hassett, The Human Disaster of Unemployment, New York Times.

Rick Newman, To Fix the Federal Reserve, Fix Congress First, US News.

George F. Will, The Trap of the Federal Reserve’s Dual Mandate, Washington Post.

Ken McLean, The Fed’s Dual Mandate Dates to a 1946 Act, Washington Post.

Image: Official portrait of Federal Reserve chair Ben Bernanke, from this source.

Hi Susan……Ben Bernanke is a whipping boy for people like Ron Paul and others. It is hard to take Paul seriously. I mean, every industrialized country has a Central Bank, and it is impossible to imagine the U.S. dropping out of that system. Criticism of Fed policies is fine, but “End The Fed”? Please……

I read Henry Paulson’s On the Brink and think every American owes thanks to the people that worked around the clock to prevent a total financial meltdown….it is easy to forget the Crisis of Fall 2008…….the world was literally on the verge of another Great Depression…….were mistakes made? Of course, but people should inform themselves before passing judgment.

What would the alternative to the Fed be? Do people really want to put U.S. monetary policy in the hands of Congress? The idea is absurd…….this is a topic that will be debated for decades to come…….just like FDR’s New Deal……which Bernanke studied and taught at Princeton……..he has been consistent in saying that will never happen again…….I trust him.

Reading about earlier panics as I was writing this post brought home how much worse the crisis of 2008 could have been. Unmeasured attacks on the Fed show its enemies to be creatures of folly. Our economy has many problems, which destroying the Fed will do nothing to solve. In fact, many of our problems are more cultural than structural; tearing down the structure will do nothing for us.

Thanks for yet another thoughtful comment, Joe.

SB

Susan – I’ll repost this as many times as I can…Thanks for your posting!

Michele–Thanks–I’m grateful for your enthusiasm. It’s good to hear from you again! All the best, Susan

An interesting article~~but I can’t agree with your claim that the American private sector created the problem of our current economic woes. A congress which has consistently mismanaged fiscal policy is mostly to blame, I think. Spending money the gov’t does not have, borrowing too much money we can’t pay back, getting in wars that are unaffordable, etc, etc. In essence: not “guiding” that $15 trillion-dollar GDP you mention. Taking too much from some, taking not enough from others, heck, I could go on and on……..Nevertheless, your article is good food for thought.